Agents for Enterprise Payments

Agents manage invoice-to-pay and recurring payment processes for high-volume enterprises with oversight.

Bridge cash flow gaps with performance-based credit lines while your agents optimize payment workflows.

Recent Agent Activity

Let Agents Handle Your Payables

Create trustworthy agents that handle your payables with precision, reducing overhead while maintaining the control and oversight you need.

Invoice-to-Payment Processing

Complete invoice-to-payment automation with bridge credit lines and working capital solutions to optimize your cash flow.

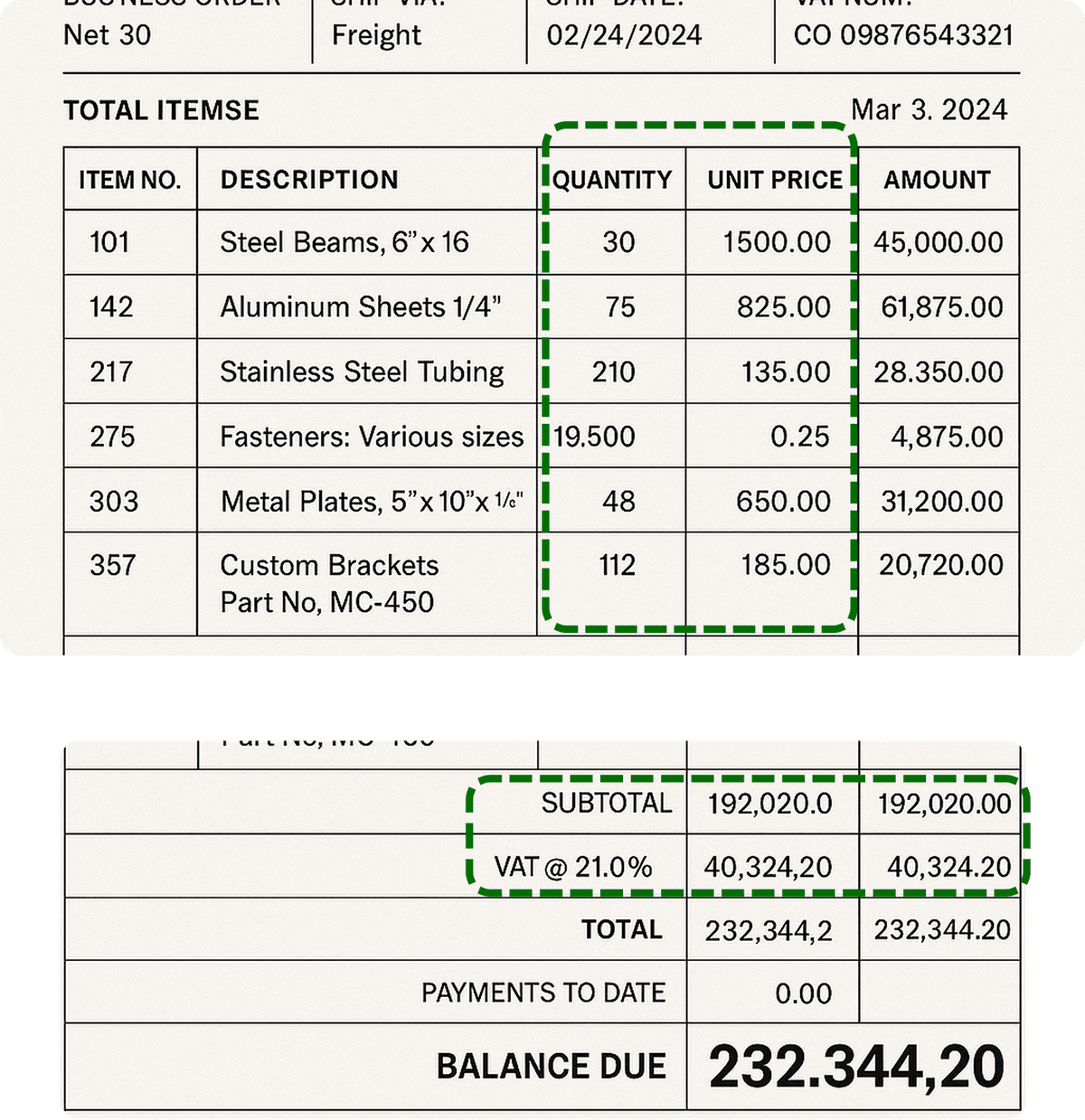

Smart Invoice Capture

AI extracts data from any invoice format

Vendor Communication

Automated vendor queries and confirmations

Vendor Verification

Real-time vendor validation and compliance

Bank Account Check

Secure payment routing verification

G702/703 Processing

Construction payment application handling

Cost Center Allocation

Intelligent project and department coding

Tax Validation

Automated tax calculations and compliance

Automated Workflows

End-to-end processing with human oversight

Ready in Minutes, Not Months

Deploy intelligent agents that learn your business rules and handle complex invoice processing workflows with minimal setup.

Prompt to Production in Minutes

See how Dunly builds intelligent payment workflows from natural language instructions

Simple Prompt

"Pull all transportation and logistics bills due in the next month and pay them if under $500"

Dunly already knows your systems, data, and integrations. Just tell us what you want to automate.

AI Creates Full Workflow

Dunly decides which tools to use and shows complete chain of thought

Customize & Add Safeguards

Fine-tune the workflow, add business rules, and create multiple safety checks

Deploy & Monitor Insights

Logistics Bills Agent

Why Dunly?

Create Payment Agents

Point-and-click builder spins up autonomous agents for AP and payment workflows in minutes.

Human-in-the-loop controls

Finance leaders set guardrails; agents escalate edge cases for one-click approval

Industry presets

Manufacturing, Restaurants, Trading, Services; agent templates match sector-specific workflows

Negotiation and Incentives

Agents negotiate on payments based on pre-set rules, optimize pay-dates for early-pay discounts.

Dunly Credit Card

Balance Your Books with Smart Credit Lines

Based on your payables performance and payment history, Dunly provides easy access to temporary credit lines. Bridge cash flow gaps and maintain healthy working capital while your AI agents optimize payment workflows.

Core Features

Agent Workflow Builder

Visual, drag-and-drop interface to create intelligent payment agents with custom rules and automation

Bill Processing

Automated bill processing and data extraction with AI-powered recognition

PO Matching & 3-Way Matching

Automated purchase order matching with invoice and receipt validation for complete audit trails

Create Rules and Guidelines

Set strict operating guidelines and boundaries for your payment agents

Payment Reconciliation

Automated payment matching, PO matching, and streamlined reconciliation processes

ERP, Banking & Procurement Integrations

Seamless connections to QuickBooks, NetSuite, banks, procurement systems, and inventory management for unified workflows

Built for Industries with Complex Payables

Dunly automates time-consuming payment processes in industries with high transaction volumes and complex vendor relationships

Manufacturing

Streamline supplier payments and vendor management with automated PO matching and inventory integration

Construction

Handle project payments and vendor settlements with milestone-based approval workflows

Logistics

Automate transportation payments and freight settlements with real-time tracking integration